In this article, we are going to provide you with Class 12 FMM Chapter 5 notes. So, if you are a student of class 12 and are afraid of examinations as you do not study anything in FMM.

So, this article is going to be very helpful for you to prepare for financial markets management class 12 chapter 5 very quickly. this article is just for you. In this article, we will tell you about each and every topic and concept of chapter 5 of class 12 fmm book.

So, before we start with class 12 financial marketing management chapter 5 notes. We would like to remind you to keep your pen and notebook on your study table to note down these notes quickly.

Futures Contracts, Mechanism and Pricing- Class 12 FMM Chapter 5 Notes

As you studied in the previous chapter of the class 12th FMM book that derivatives have become increasingly important in the field of finance.

In chapter 4 we studied that futures and options are now actively traded on several exchanges, forward contracts are popular on the OTC market. After reading Class 12 FMM Chapter 5 Notes we would like to suggest you read our notes for other chapters of FMM Class 12.

The links to notes of class 12 FMM chapter 1, 2, 3, and 4 are given at the end of this article.

What are Forward Contracts?

A Forward contract is a type of legal agreement to buy or sell an asset on a specified date for a specified price.

Therefore it is a forward commitment type of derivative. The forward contracts are normally traded outside the exchanges, in the OTC market.

There are several salient features of Forward Contacts but some of the main salient features of the Foward contracts are given below:

1. The Forward Contracts are bilateral contracts and hence exposed to the counter-party risk. The Counterparty risk is the risk that the other party to the contract may not honor their part of the agreement.

2. In it, each contract is custom designed, and hence is unique in terms of the expiration date, contract size, and type as well as the quality of the asset.

Even the storage and delivery terms may be negotiated mutually and built into the contract. It helps in providing higher flexibility to the parties to the contract.

3. The contract price is generally not provided in the public domain as these domains are negotiated privately.

4. On the expiration date, the contract has to be settled by the delivery of that asset. It may also be a cash-settled case, as agreed by the parties at the inception of that contract.

In the case of cash settlement, the parties pay/receive the loss or gain arising from the contract to them in cash to the other party.

5. In case the party wishes to reverse the contract so it has to compulsorily go to the same counterparty, which often results in high prices being charged.

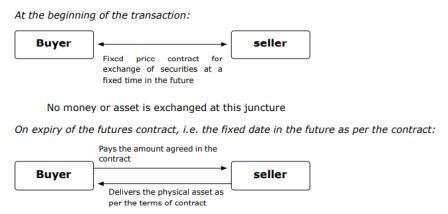

Forward Contract Illustration

You can understand the Illustration ad working of the Forward contracts from the image given below. We hope that this image might be very helpful for you.

Some Limitations of Forward Market

There are several problems or limitations that are faced by the Forward Market all over the World. So, the three main limitations of the forward Market are as follows:

1. Illiquidity: Because of the customized nature of each contract, it would be difficult to trade it in the open market as specifications would be different from one investor to another.

2. Counterparty Risk: The Counterparty risk shows the risk of default by any party to the transaction. The Counterparty risk is quite high in the case of Forward contracts.

When one of the two sides to the transaction declares bankruptcy, in that case, the other had to suffer.

3. Lack of Centralization of trading: In it, each contract is negotiated bilaterally and is not listed on any centralized platform such as the stock exchange.

Introduction of Future

A futures contract is a legal agreement between two parties to sell or buy an asset at a certain time period in the future and at a certain price. In the case of facilitating liquidity in the futures contracts, the exchange specifies certain standard features of that contract.

Basically, the futures contracts are created by the share exchange and made available for trade in the open market.

In other words future is a standardized contract with the standard underlying instrument, it is a standard quantity and quality of the underlying instrument that can be delivered. There are five main standardized items in a futures contract. These standardized items in the future are given below:

- The quality of underlying

- The quantity of underlying

- The location of the settlement

- Unit of the price quotation and minimum price change

- Month and date of the delivery

Difference between Forwards Contracts and Futures

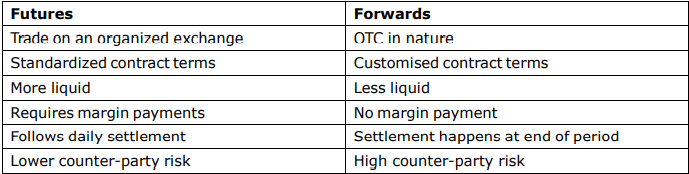

Futures contracts are often confused with forward contracts. The confusion is primarily because both future contracts and forward contracts are served essentially the same economic functions of allocating risk in the presence of future price uncertainty.

However, futures are a significant improvement over forward contracts as they eliminate counterparty risk and offer more liquidity. You can read the differences between Futures contracts and forwards contracts from the differentiation table given below:

If you want an article related to Class 12 FMM Chapter 5 Notes and some more important questions about class 12 Financial Markets Management, follow our blog now to get a notification of the latest updates.

We hope that this Class 12 FMM Chapter 5 Notes might be very helpful for you and if you are interested in learning other chapters of FMM class 12th. So, these are given below:

- Class 12 FMM Chapter 1 Notes

- Class 12 FMM Chapter 2 Notes

- Class 12 FMM Chapter 3 Notes

- Class 12 FMM Chapter 4 Notes

- Class 12 FMM Chapter 5 Notes- Given in this article.