Hello Everyone, in this article we are going to provide you Financial Markets Management Class 12 Chapter 4 Notes for free.

So, if you are a student of class 12 and want to prepare Chapter 4 of fmm in a few minutes. So, this article is just for you.

In this article, we will tell you about each and every concept of chapter 4 of class 12 fmm book. So, let’s start with our notes. Before starting to learn from these notes we would like to recommend you to read these notes very carefully and note them down for further revision if you wish to do so.

Introduction to Derivatives

The name of this chapter tells us about the main topic of this chapter which is ‘Derivatives’. So, in this chapter, we are going to learn about what are derivatives with examples and assumptions, and types of derivatives. This article is going to be very helpful for you.

If you want more interesting notes for other chapters of class 12 financial marketing management. So, these are given at the bottom of this article you can read them from the end of this article.

What is Derivative?

The Derivative is a kind of contract whose price is derived from or is dependent upon an underline asset. The underlying asset could be a financial asset such as stock and market index, currency, derivative contracts, and trade on electricity, weather, temperature, and even volatility.

According to the securities contract regulation act of 1956, the term derivative includes two different factors:

- A security derived from a depth instrument, loan, share, whether it is a secured or unsecured, risk instrument, or contract for differences of any other form of security.

- This contract derives its value from the index of prices and the price of underline securities.

Let’s understand this concept with an assumption:

Let you be a farmer who owns 10 acres of land. Now you can either cultivate rice in all 10-acre land or cultivator rice on half land and wheat in the remaining half part. In case the demand for wheat is higher in that year so you would be at loss and if you cultivate wheat and rice in equal quantity so you will lose out on the potentially high profit that is arising in the rice crop.

After understanding this assumption you may think so how can we resolve this issue? So to resolve this issue you can enter into a contract with a distributor to purchase all your product. Whether it is an all rice crop or half rice and half wheat crop. Using this way you can ensure that whatever is agreed upon if you cultivate it so there may be no chances of your loss in cultivating any one of the crops or both crops in half-half land.

In the above case, the agreement that we did for our crop is a derivative contract where the underline asset is the produce.

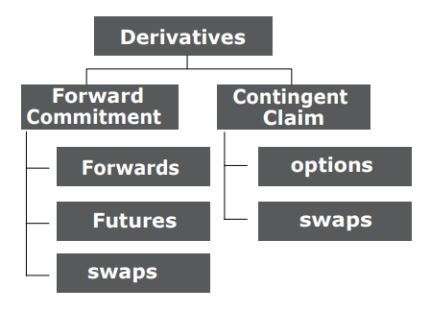

Types of Derivatives

There are divided on the basis of three main factors:

- On the basis of the nature of the derivative contract

- On the basis of the Underlying assets

- On the basis of the place of trading

On the basis of the nature of the derivative contracts

On the basis of the nature of the derivative contracts, the derivatives are divided into 2 sub-categories:

- Forward Commitment

- Contingent Claim

Some very helpful notes that you should also read:

- Financial Markets Management Class 12 Chapter 1 Notes

- Financial Markets Management Class 12 Chapter 2 Notes

- Financial Markets Management Class 12 Chapter 3 Notes

- Financial Markets Management Class 12 Chapter 5 Notes